fulton county ga sales tax rate 2021

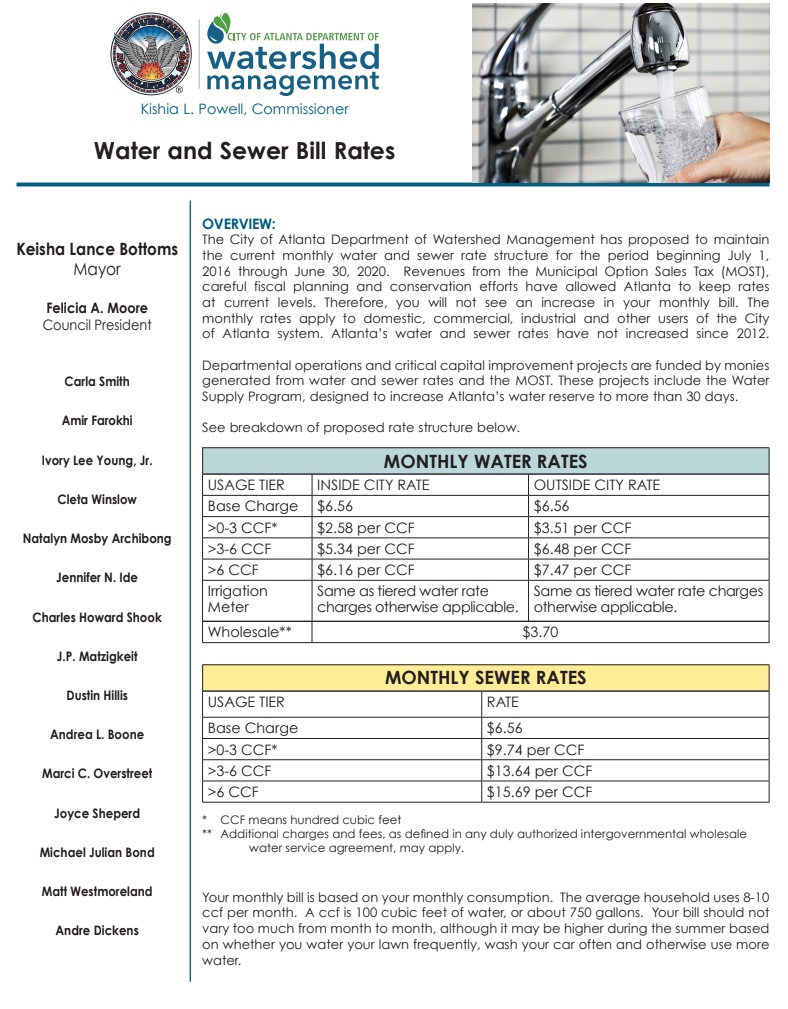

Fulton County collects an additional. Effective July 1 2021 Code 000 - The state sales and use tax rate is 4 and is included in the jurisdiction rates below.

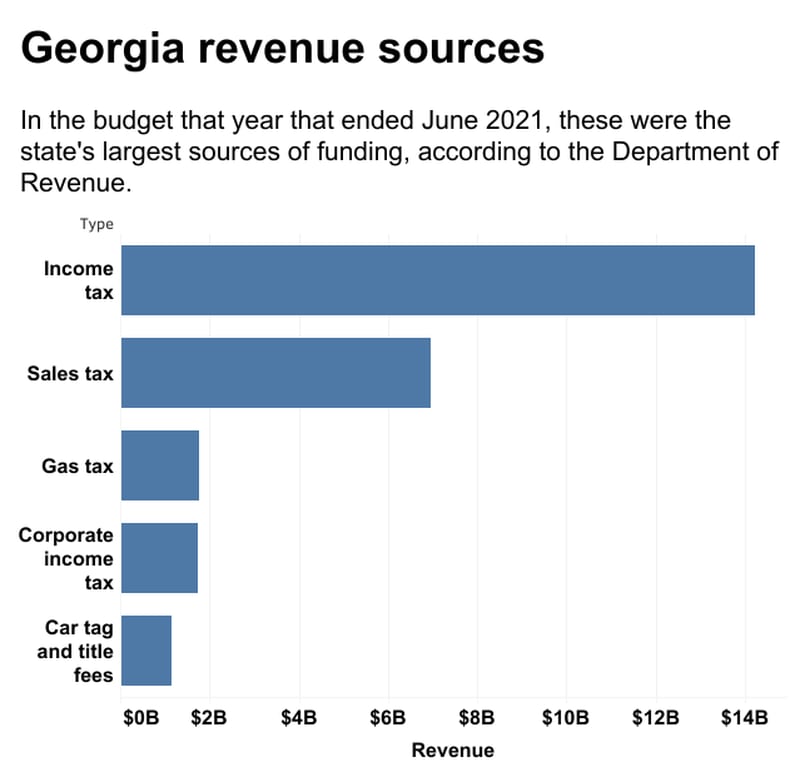

Department Of Revenue Tax Digest Data Georgia Data

3 rows The current total local sales tax rate in Fulton County GA is 7750.

. The local sales tax rate in Fulton County is 3 and the maximum rate including Georgia and city sales taxes is 89 as of November 2022. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Georgia State Sales Tax.

This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction. For sales of motor vehicles that are subject to sales and use tax Georgia law provides for limited exemptions from certain local taxes.

OFfice of the Tax Commissioner. This is the total of state and county sales tax rates. Georgia state sales and use tax rate is 4 percent.

The December 2020. The Fulton County Board of Commissioners does hereby announce that the 2021 General Fund millage rate will be set at a meeting to be held at the Fulton County Assembly. What is the sales tax rate in Fulton County.

2022 List of Georgia Local Sales Tax Rates. Code Jurisdiction Rate Type Code Jurisdiction Rate. GEORGIA SALES AND USE TAX RATE CHART Effective January 1 2021 Code 000 - The state sales and use tax rate is 4 and is included in the jurisdiction rates below.

Inside the City of Atlanta in both DeKalb County and. The latest sales tax rate for Atlanta GA. The 89 sales tax rate in Atlanta consists of 4 Georgia state sales tax 3 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl.

Lowest sales tax 6 Highest sales tax. Fulton County sales tax is a rate of tax a consumer must pay when purchasing goods and some services in Fulton County Georgia and that a business must collect from their customers. Fulton County Sheriffs Tax Sales are held on the first.

141 Pryor Street SW. 890 Is this data incorrect. Rate Changes Effective October 1 2022 1627 KB Rate Changes Effective July 1 2022 1113.

Upcoming quarterly rate changes. Click any locality for a full breakdown of local property taxes or visit our Georgia sales tax calculator to lookup local rates by zip code. 2022 Georgia Sales Tax By County.

Sales Tax - Upcoming Quarterly Rate Changes. Fulton County Sales Tax. The minimum combined 2022 sales tax rate for Fulton County Georgia is.

Fulton County has a combined sales tax of 775 percent outside of Atlanta 89 percent inside Atlanta.

Vote Yes For Infrastructure Funding May 24

Fulton County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Gop Hopefuls In 2022 Want To Eliminate Georgia Income Tax

Fulton County Tax Commissioner

Oc Effective Sales Tax Rates In Georgia R Atlanta

Georgia Income Tax Calculator Smartasset

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

Short Term Rental Airbnb Regulation Atlanta Metro Ga Chalet

Georgia Sales Tax Guide And Calculator 2022 Taxjar

Property Taxes By County Interactive Map Tax Foundation

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

Best Counties For Buying Single Family Rentals In 2021 Attom

Chicago Sales Tax Rate And Calculator 2021 Wise

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

How To Perform Line Level Tax Calculation For Sales Orders Dynamics 365 Business Central Forum Community Forum

Georgia Property Tax Increases Among Highest In Nation 11alive Com